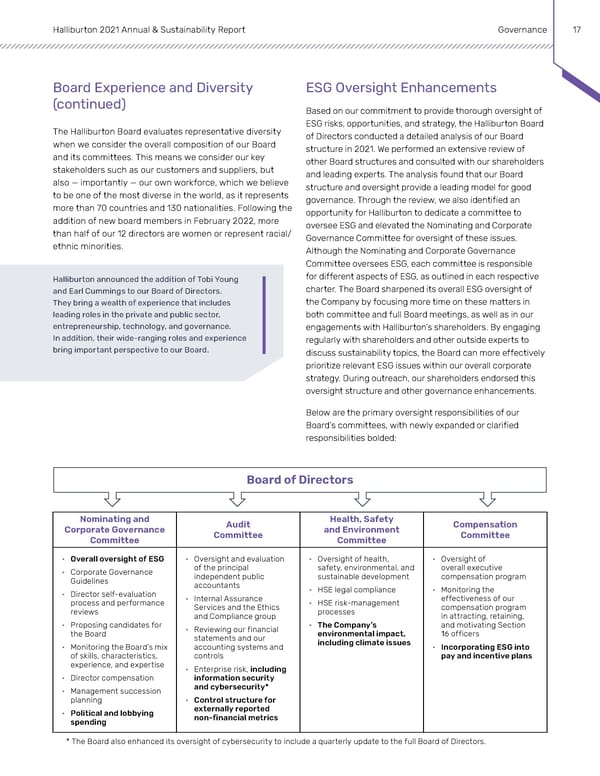

Halliburton 2021 Annual & Sustainability Report Governance 17 Board Experience and Diversity ESG Oversight Enhancements (continued) Based on our commitment to provide thorough oversight of ESG risks, opportunities, and strategy, the Halliburton Board The Halliburton Board evaluates representative diversity of Directors conducted a detailed analysis of our Board when we consider the overall composition of our Board structure in 2021. We performed an extensive review of and its committees. This means we consider our key other Board structures and consulted with our shareholders stakeholders such as our customers and suppliers, but and leading experts. The analysis found that our Board also — importantly — our own workforce, which we believe structure and oversight provide a leading model for good to be one of the most diverse in the world, as it represents governance. Through the review, we also identified an more than 70 countries and 130 nationalities. Following the opportunity for Halliburton to dedicate a committee to addition of new board members in February 2022, more oversee ESG and elevated the Nominating and Corporate than half of our 12 directors are women or represent racial/ Governance Committee for oversight of these issues. ethnic minorities. Although the Nominating and Corporate Governance Committee oversees ESG, each committee is responsible Halliburton announced the addition of Tobi Young for different aspects of ESG, as outlined in each respective and Earl Cummings to our Board of Directors. charter. The Board sharpened its overall ESG oversight of They bring a wealth of experience that includes the Company by focusing more time on these matters in leading roles in the private and public sector, both committee and full Board meetings, as well as in our entrepreneurship, technology, and governance. engagements with Halliburton’s shareholders. By engaging In addition, their wide-ranging roles and experience regularly with shareholders and other outside experts to bring important perspective to our Board. discuss sustainability topics, the Board can more effectively prioritize relevant ESG issues within our overall corporate strategy. During outreach, our shareholders endorsed this oversight structure and other governance enhancements. Below are the primary oversight responsibilities of our Board’s committees, with newly expanded or clarified responsibilities bolded: Board of Directors Nominating and Audit Health, Safety Compensation Corporate Governance Committee and Environment Committee Committee Committee • Overall oversight of ESG • Oversight and evaluation • Oversight of health, • Oversight of • Corporate Governance of the principal safety, environmental, and overall executive Guidelines independent public sustainable development compensation program accountants • HSE legal compliance • Monitoring the • Director self-evaluation • Internal Assurance effectiveness of our process and performance Services and the Ethics • HSE risk-management compensation program reviews and Compliance group processes in attracting, retaining, • Proposing candidates for • Reviewing our financial • The Company’s and motivating Section the Board statements and our environmental impact, 16 officers • Monitoring the Board’s mix accounting systems and including climate issues • Incorporating ESG into of skills, characteristics, controls pay and incentive plans experience, and expertise • Enterprise risk, including • Director compensation information security • Management succession and cybersecurity* planning • Control structure for • Political and lobbying externally reported spending non-financial metrics * The Board also enhanced its oversight of cybersecurity to include a quarterly update to the full Board of Directors.

Governance Page 2 Page 4

Governance Page 2 Page 4